| Main Page | TFRSs (Revised) | Accounting Manuals for TFRSs |

Articles / News |

| Revised 2018 | |||

| Revised 2017 | |||

| Revised 2016 | |||

| Revised 2015 | |||

| Revised 2014 | |||

| Revised 2012 | |||

| Revised 2009 |

Revised 2017

Thai Financial Reporting Standards (TFRS) contain copyright material of the IFRS® Foundation (Foundation) in respect of which all rights are reserved.

Reproduced and distributed by the Federation of Accounting Professions with the permission of the Foundation within the Kingdom of Thailand only. No rights granted to third parties to reproduce, store in a retrieval system or transmit in any form or in any means without the prior written permission of the Federation of Accounting Professions and the Foundation.

Thai Financial Reporting Standards (TFRS) are issued by the Federation of Accounting Professions in respect of their application in the Kingdom of Thailand and have not been prepared or endorsed by the International Accounting Standards Board (Board).

Thai Financial Reporting Standards (TFRS) are not to be distributed outside of the Kingdom of Thailand.

Thai Accounting Standards – Setting Committee translated and adopted Thai Financial Reporting Standards (“TFRS”) revised 2017 based on the 2017 edition of the bound volume of International Financial Reporting Standards (“IFRS”) (Bound Volume 2017 Consolidated without early application) which are effective in Thailand for annual reporting periods beginning on or after 1 January 2018.

Due process and amendments to Thai Accounting Standards and Thai Financial Reporting Standards in 2017

There are 3 amendments to TFRSs in this version (revised 2017) which are TAS 7 Statement of Cash Flows, TAS 12 Income Taxes and TFRS 12 Disclosure of Interests in Other Entities. Please see the summary of amendments as below.

| Thai Financial Reporting Standards | Amendment |

| TAS 7 Statement of Cash Flows | The amendments to TAS 7 Statement of Cash Flows respond to investors’ requests for improved disclosures about changes in an entity’s liabilities arising from financing activities. The amendments require entities to provide disclosures that enable users of financial statements to evaluate changes in liabilities arising from financing activities, including both changes arising from cash flows and non-cash changes. |

|

TAS 12 Income Taxes |

TAS 12 Income Taxes provides requirements on the recognition and measurement of current or deferred tax liabilities or asset. These amendments clarify the requirements on recognition of deferred tax assets for unrealized losses. |

| TFRS 12 Disclosure of Interests in Other Entities | The amendments clarify that, except for the requirements to disclose summarised financial information, the requirements of TFRS 12 apply to interests in other entities within the scope of TFRS 5. |

Moreover, there is the new Thai Accounting Guidance which is “Thai Accounting Guidance: Preparation financial statements on other basis which is not a going concern basis”. In the guidance are consist of;

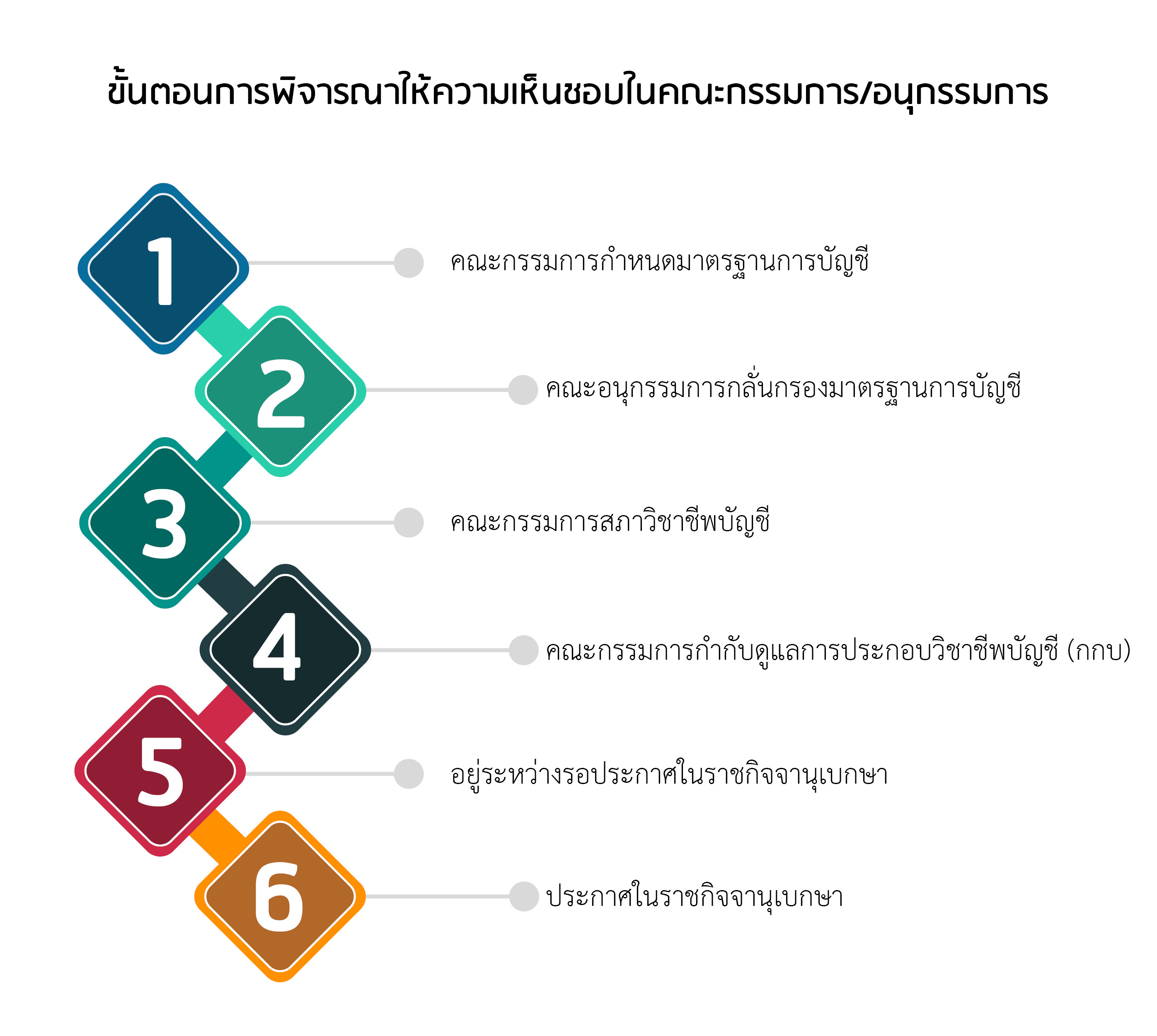

The approved process of TFRS by Sub-Committee and Committee

1. Thai Accounting Standard-Setting Committee

2. Accounting Standard Scrutinizing Sub-Committee

3. Federation of Accounting Professions Board

4. Oversight Committee on Accounting Professions

5. On process for announced in Royal Gazette\

6. Announced in Royal Gazette

Remark: Draft of Thai Financial Reporting Standards which are approved by The Thai Accounting Standards – Setting Committee, the entity can download it to understand and prepare yourself.

| Due Process of Thai Financial Reporting Standards (Due process) Click | |

| TAS = Thai Accounting Standards | TFRS = Thai Financial Reporting Standards |

| TSIC = TSIC Interpretations | TFRIC = TFRIC Interpretations |

| No. | Ref. | Title | Date of publishing draft | Effective date | Progress | Date in the Royal Gazette | Remark |

| 1 | TAS 1 (revised 2017) |

Presentation of Financial Statements | 7 Apr 2017 | 1 Jan 2018 | 6 | 26 Sep 2017 | |

| 2 | TAS 2 (revised 2017) |

Inventories | 7 Apr 2017 | 1 Jan 2018 | 6 | 26 Sep 2017 | |

| 3 | TAS 7 (revised 2017) |

Statement of Cash Flows | 27 Apr 2017 | 1 Jan 2018 | 6 | 26 Sep 2017 | |

| 4 | TAS 8 (revised 2017) |

Accounting Policies, Changes in Accounting Estimates and Errors | 7 Apr 2017 | 1 Jan 2018 | 6 | 26 Sep 2017 | |

| 5 | TAS 10 (revised 2017) |

Events after the Reporting Period | 7 Apr 2017 | 1 Jan 2018 | 6 | 26 Sep 2017 | |

| 6 | TAS 11 (revised 2017) |

Construction Contracts | 7 Apr 2017 | 1 Jan 2018 | 6 | 26 Sep 2017 | |

| 7 | TAS 12 (revised 2017) |

Income Taxes | 27 Apr 2017 | 1 Jan 2018 | 6 | 26 Sep 2017 | |

| 8 | TAS 16 (revised 2017) |

Property, Plant and Equipment | 7 Apr 2017 | 1 Jan 2018 | 6 | 26 Sep 2017 | |

| 9 | TAS 17 (revised 2017) |

Leases | 7 Apr 2017 | 1 Jan 2018 | 6 | 26 Sep 2017 | |

| 10 | TAS 18 (revised 2017) |

Revenue | 7 Apr 2017 | 1 Jan 2018 | 6 | 26 Sep 2017 | |

| 11 | TAS 19 (revised 2017) |

Employee Benefits | 7 Apr 2017 | 1 Jan 2018 | 6 | 26 Sep 2017 | |

| 12 | TAS 20 (revised 2017) |

Accounting for Government Grants and Disclosure of Government Assistance | 7 Apr 2017 | 1 Jan 2018 | 6 | 26 Sep 2017 | |

| 13 | TAS 21 (revised 2017) |

The Effects of Changes in Foreign Exchange Rates | 7 Apr 2017 | 1 Jan 2018 | 6 | 26 Sep 2017 | |

| 14 | TAS 23 (revised 2017) |

Borrowing Costs | 7 Apr 2017 | 1 Jan 2018 | 6 | 26 Sep 2017 | |

| 15 | TAS 24 (revised 2017) |

Related Party Disclosures | 7 Apr 2017 | 1 Jan 2018 | 6 | 26 Sep 2017 | |

| 16 | TAS 26 (revised 2017) |

Accounting and Reporting by Retirement Benefit Plans | 7 Apr 2017 | 1 Jan 2018 | 6 | 26 Sep 2017 | |

| 17 | TAS 27 (revised 2017) |

Separate Financial Statements | 7 Apr 2017 | 1 Jan 2018 | 6 | 26 Sep 2017 | |

| 18 | TAS 28 (revised 2017) |

Investments in Associates and Joint Ventures | 7 Apr 2017 | 1 Jan 2018 | 6 | 26 Sep 2017 | |

| 19 | TAS 29 (revised 2017) |

Financial Reporting in Hyperinflationary Economies | 7 Apr 2017 | 1 Jan 2018 | 6 | 26 Sep 2017 | |

| 20 | TAS 33 (revised 2017) |

Earnings per Share | 7 Apr 2017 | 1 Jan 2018 | 6 | 26 Sep 2017 | |

| 21 | TAS 34 (revised 2017) |

Interim Financial Reporting | 7 Apr 2017 | 1 Jan 2018 | 6 | 26 Sep 2017 | |

| 22 | TAS 36 (revised 2017) |

Impairment of Assets | 7 Apr 2017 | 1 Jan 2018 | 6 | 26 Sep 2017 | |

| 23 | TAS 37 (revised 2017) |

Provisions, Contingent Liabilities and Contingent Assets | 7 Apr 2017 | 1 Jan 2018 | 6 | 26 Sep 2017 | |

| 24 | TAS 38 (revised 2017) |

Intangible Assets | 7 Apr 2017 | 1 Jan 2018 | 6 | 26 Sep 2017 | |

| 25 | TAS 40 (revised 2017) |

Investment Property | 7 Apr 2017 | 1 Jan 2018 | 6 | 26 Sep 2017 | |

| 26 | TAS 41 (revised 2017) |

Agriculture | 7 Apr 2017 | 1 Jan 2018 | 6 | 26 Sep 2017 | |

| 27 | TFRS 2 (revised 2017) |

Share-based Payment | 7 Apr 2017 | 1 Jan 2018 | 6 | 26 Sep 2017 | |

| 28 | TFRS 3 (revised 2017) |

Business Combinations | 7 Apr 2017 | 1 Jan 2018 | 6 | 26 Sep 2017 | |

| 29 | TFRS 4 (revised 2017) |

Insurance Contracts | 7 Apr 2017 | 1 Jan 2018 | 6 | 26 Sep 2017 | |

| 30 | TFRS 5 (revised 2017) |

Non-current Assets Held for Sale and Discontinued Operations | 7 Apr 2017 | 1 Jan 2018 | 6 | 26 Sep 2017 | |

| 31 | TFRS 6 (revised 2017) |

Exploration for and Evaluation of Mineral Resources | 7 Apr 2017 | 1 Jan 2018 | 6 | 26 Sep 2017 | |

| 32 | TFRS 8 (revised 2017) |

Operating Segments | 7 Apr 2017 | 1 Jan 2018 | 6 | 26 Sep 2017 | |

| 33 | TFRS 10 (revised 2017) |

Consolidated Financial Statements | 7 Apr 2017 | 1 Jan 2018 | 6 | 26 Sep 2017 | |

| 34 | TFRS 11 (revised 2017) |

Joint Arrangements | 7 Apr 2017 | 1 Jan 2018 | 6 | 26 Sep 2017 | |

| 35 | TFRS 12 (revised 2017) |

Disclosure of Interests in Other Entities | 27 Apr 2017 | 1 Jan 2018 | 6 | 26 Sep 2017 | |

| 36 | TFRS 13 (revised 2017) |

Fair Value Measurement | 7 Apr 2017 | 1 Jan 2018 | 6 | 26 Sep 2017 | |

| TFRIC Interpretations and SIC Interpretations | |||||||

| 37 | TSIC 10 (revised 2017) |

Government Assistance-No Specific Relation to Operating Activities | 7 Apr 2017 | 1 Jan 2018 | 6 | 26 Sep 2017 | |

| 38 | TSIC 15 (revised 2017) |

Operating Leases-Incentives | 7 Apr 2017 | 1 Jan 2018 | 6 | 26 Sep 2017 | |

| 39 | TSIC 25 (revised 2017) |

Income Taxes-Changes in the Tax Status of an Entity or its Shareholders | 7 Apr 2017 | 1 Jan 2018 | 6 | 26 Sep 2017 | |

| 40 | TSIC 27 (revised 2017) |

Evaluating the Substance of Transactions Involving the Legal Form of a Lease | 7 Apr 2017 | 1 Jan 2018 | 6 | 26 Sep 2017 | |

| 41 | TSIC 29 (revised 2017) |

Service Concession Arrangements: Disclosures | 7 Apr 2017 | 1 Jan 2018 | 6 | 26 Sep 2017 | |

| 42 | TSIC 31 (revised 2017) |

Revenue-Barter Transactions Involving Advertising Services | 7 Apr 2017 | 1 Jan 2018 | 6 | 26 Sep 2017 | |

| 43 | TSIC 32 (revised 2017) |

Intangible Assets-Web Site Costs | 7 Apr 2017 | 1 Jan 2018 | 6 | 26 Sep 2017 | |

| 44 | TFRIC 1 (revised 2017) |

Changes in Existing Decommissioning, Restoration and Similar Liabilities | 7 Apr 2017 | 1 Jan 2018 | 6 | 26 Sep 2017 | |

| 45 | TFRIC 4 (revised 2017) |

Determining whether an Arrangement contains a Lease | 7 Apr 2017 | 1 Jan 2018 | 6 | 26 Sep 2017 | |

| 46 | TFRIC 5 (revised 2017) |

Rights to Interests arising from Decommissioning, Restoration and Environmental Rehabilitation Funds | 7 Apr 2017 | 1 Jan 2018 | 6 | 26 Sep 2017 | |

| 47 | TFRIC 7 (revised 2017) |

Applying the Restatement Approach under TAS 29 Financial Reporting in Hyperinflationary Economies | 7 Apr 2017 | 1 Jan 2018 | 6 | 26 Sep 2017 | |

| 48 | TFRIC 10 (revised 2017) |

Interim Financial Reporting and Impairment | 7 Apr 2017 | 1 Jan 2018 | 6 | 26 Sep 2017 | |

| 49 | TFRIC 12 (revised 2017) |

Service Concession Arrangements | 7 Apr 2017 | 1 Jan 2018 | 6 | 26 Sep 2017 | |

| 50 | TFRIC 13 (revised 2017) |

Customer Loyalty Programmes | 7 Apr 2017 | 1 Jan 2018 | 6 | 26 Sep 2017 | |

| 51 | TFRIC 14 (revised 2017) |

TAS 19-The Limit on a Defined Benefit Asset, Minimum Funding Requirements and their Interaction | 7 Apr 2017 | 1 Jan 2018 | 6 | 26 Sep 2017 | |

| 52 | TFRIC 15 (revised 2017) |

Agreements for the Construction of Real Estate | 7 Apr 2017 | 1 Jan 2018 | 6 | 26 Sep 2017 | |

| 53 | TFRIC 17 (revised 2017) |

Distributions of Non-cash Assets to Owners | 7 Apr 2017 | 1 Jan 2018 | 6 | 26 Sep 2017 | |

| 54 | TFRIC 18 (revised 2017) |

Transfers of Assets from Customers | 7 Apr 2017 | 1 Jan 2018 | 6 | 26 Sep 2017 | |

| 55 | TFRIC 20 (revised 2017) |

Stripping Costs in the Production Phase of a Surface Mine | 7 Apr 2017 | 1 Jan 2018 | 6 | 26 Sep 2017 | |

| 56 | TFRIC 21 (revised 2017) |

Levies | 7 Apr 2017 | 1 Jan 2018 | 6 | 26 Sep 2017 | |

New Thai Financial Reporting Standard

Thai Accounting Standards – Setting Committee is in the process of translated and adopted New Thai Financial Reporting Standards (“TFRS”) based on International Financial Reporting Standards (“IFRS”) (Bound Volume 2018 Consolidated without early application) as follows;

TFRS 1 First-time Adoption of Thai Financial Reporting Standards: the objective of this standards is to ensure that an entity’s first TFRS financial statements and its interim financial reports for part of the period covered by those financial statements, contain high quality information that is transparent for users and comparable over all periods presented, provides a suitable starting point for accounting in accordance with TFRS and can be generated at a cost that does not exceed the benefits.

TFRS 15 and TFRS 16 will be effective in Thailand for annual reporting periods beginning on or after 1 January 2019 and 1 January 2020.

| No. | Ref. | Title | Date of publishing draft | Effective date | Progress | Date in the Royal Gazette | Remark |

| 1 | TFRS 1 | First-time Adoption of Thai Financial Reporting Standards | 2 May 2018 | 1 Jan 2019 | 1 | ||

| 2 | TFRS 15 | Revenue from Contracts with Customers | 9 Jun 2016 | 1 Jan 2019 | 6 | 14 Mar 2018 | |

| 3 | TFRS 16 | Leases | 5 Jun 2017 | 1 Jan 2020 | 3 |

Thai Accounting Guidances

Thai Accounting Standards – Setting Committee determined the Accounting Guidance for Preparation financial statements on other basis which is not a going concern basis for the dissolution entities to financial statements for the reporting period of the dissolution that is effective in Thailand for annual reporting periods beginning on or after 1 January 2018 and Accounting Guidance for Financial instruments and Presentation for Insurance business that is effective in Thailand for annual reporting periods beginning on or after 1 January 2019

| No. | Ref. | Thai Accounting Guidance Title | Date of publishing draft | Effective date | Progress | Date in the Royal Gazette |

| 1 | Non Going concern | Preparation financial statements on other basis which is not a going concern basis | 28 Apr 2017 | 1 Jan 2018 | 3 | |

| 2 | Insurance - FI & Disclose | Financial instruments and Presentation for Insurance business | 16 Feb 2018 | 1 Jan 2019 | 1 |

New Thai Financial Reporting Standards (Financial Instruments)

Thai Accounting Standards – Setting Committee is in the process of translated and adopted New Thai Financial Reporting Standards (“TFRS”) (Financial Instruments) based on the 2018 edition of the bound volume of International Financial Reporting Standards (“IFRS”) (Bound Volume 2018 Consolidated without early application) which effective in Thailand for annual reporting periods beginning on or after 1 January 2019.

| No. | Ref. | Title | Date of publishing draft | Effective date | Progress | Date in the Royal Gazette | Remark |

| 1 | TFRS 7 | Financial Instruments: Disclosures | 20 Dec 2016 | 1 Jan 2019 | 2 | ||

| 2 | TFRS 9 | Financial Instruments | 19 Dec 2016 | 1 Jan 2019 | 3 | ||

| 3 | TAS 32 | Financial Instruments: Presentation | 9 Dec 2016 | 1 Jan 2019 | 2 | ||

| 4 | TFRIC 2 | Members’ Shares in Co-operative Entities and Similar Instruments | - | 1 Jan 2019 | 2 | ||

| 5 | TFRIC 16 | Hedges of a Net Investment in a Foreign Operation | 26 Jan 2017 | 1 Jan 2019 | 2 | ||

| 6 | TFRIC 19 | Extinguishing Financial Liabilities with Equity Instruments | 26 Jan 2017 | 1 Jan 2019 | 2 |

For the other standards which are not described in the table mentioned above, are the standards which are changed only wording and the reference of the version of the standards. There are no any significant changes in the standards